Top Retailers Offering Buy Now, Pay Later Phones

- Apple's iPhone Payments: Apple offers its own payment plan, allowing you to spread the cost of a new phone over a period of months, often with no interest. You can manage the payments directly through your Apple ID. Learn more at Apple Financing.

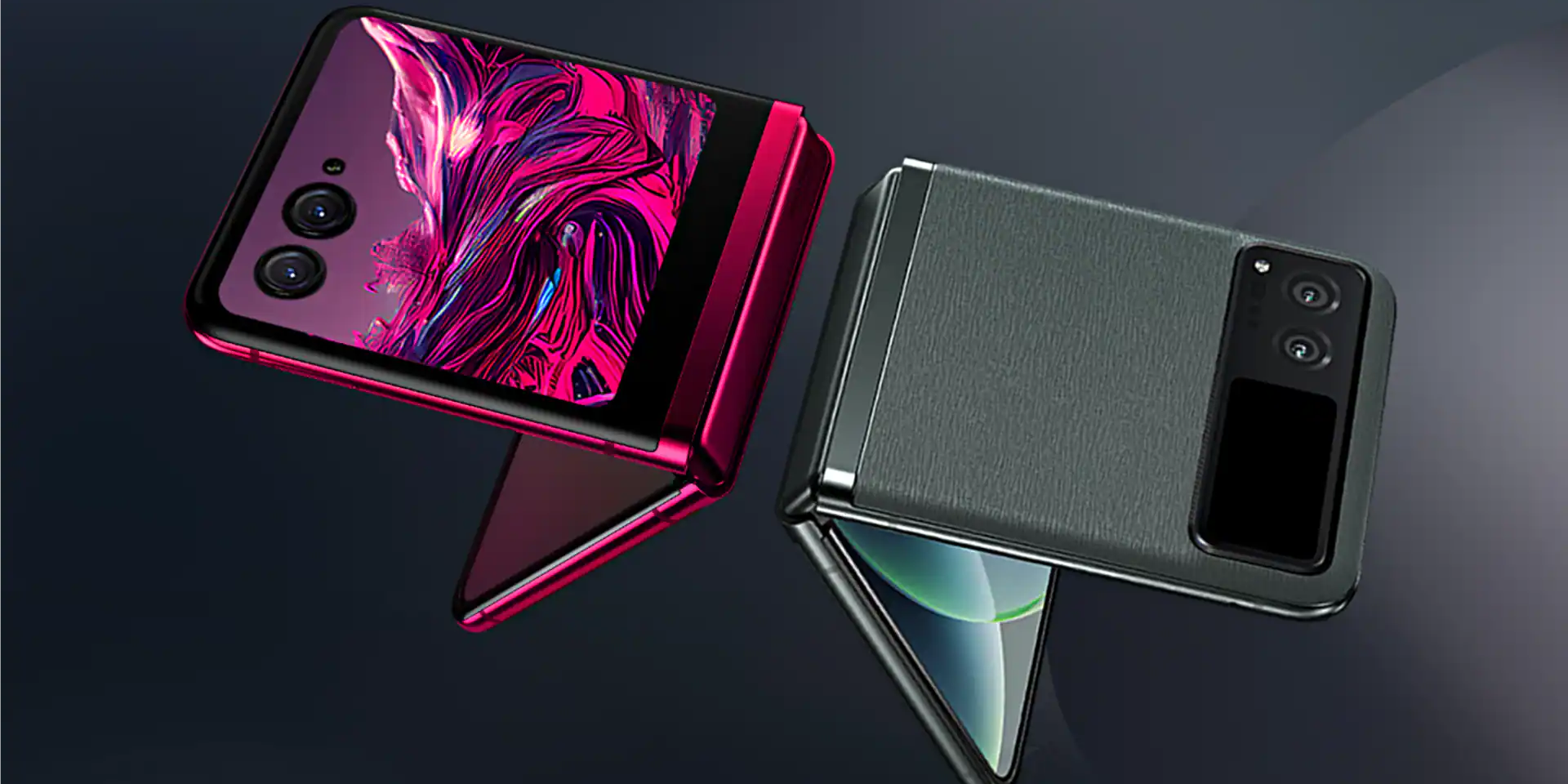

- Samsung Financing: Samsung provides financing options via Samsung Financing Account, where you can pay in monthly installments. Check out the latest offerings at Samsung Pay Later.

- AT&T Next Up: AT&T offers a financing plan that allows customers to upgrade their phones more frequently by paying an additional fee. Details can be found at AT&T Next Up.

- Best Buy: Known for its tech products, Best Buy provides financing options through its My Best Buy Credit Card, which often has promotions like 0% interest if paid in full within a certain time. More information is available at their Financing page.

Financing Options with No Credit Checks

- Affirm: Many retailers partner with Affirm, offering an easy application process and approval with soft credit checks, allowing you to avoid any impact on your credit score.

- Afterpay: This service divides payments into four equal installments due every two weeks, with no credit check required.

- Quadpay (now Zip): Quadpay splits your purchase into four interest-free payments over six weeks, with no need for a traditional credit check.

Payment Plan Comparisons

When choosing a buy now, pay later (BNPL) phone plan, it's crucial to compare the available options. Here’s a comprehensive rundown:

- Interest Rates: Some plans offer 0% interest for a promotional period, while others might charge a small interest rate. It's essential to read the terms carefully.

- Repayment Flexibility: Determine whether the plan offers flexibility in payment schedules. Some plans allow changing the due date to suit your financial situation.

- Phone Upgrade Options: Some carriers offer frequent upgrade options if you enroll in specific plans, which can be beneficial if you prefer having the latest device.

Key Pros and Cons of Buy Now, Pay Later

Pros

- Immediate Access: Get your desired phone immediately without paying the full amount upfront.

- Flexibility: Customize your payments to fit your budget, often with interest-free options available.

- No Credit Score Impact (in some cases): Options that don’t require a hard credit check safeguard your credit score.

Cons

- Potentially High Costs: Missing payments can result in fees or interest, potentially increasing the total cost of the phone.

- Limited Availability: Not all phones or models are available under BNPL plans.

- Commitment: Staggered payments mean you're locked into monthly installments, which can impact cash flow if finances are tight.

Tips to Choose the Best Deal for Your Budget and Device Needs

- Assess Your Financial Situation: Understand your monthly income and expenses to ensure you select a plan that fits comfortably within your budget.

- Compare Offers: Look at different BNPL providers and retail options to find the best interest rates and repayment terms.

- Read the Fine Print: Before signing any agreement, thoroughly read the terms and conditions to avoid any hidden fees or stipulations.

- Plan for Future Changes: Choose a plan with flexibility if you're anticipating any changes in your financial situation.

Conclusion

Buy now, pay later phone plans can be a smart solution for those who want the latest devices without the burden of upfront costs. With a wide range of retailers and third-party providers offering flexible options, it's easier than ever to find a plan that matches your financial comfort. However, it’s important to evaluate each offer carefully—consider interest rates, upgrade policies, and potential fees. Always choose a plan that aligns with your long-term budget. By staying informed and comparing options, you can enjoy modern tech without compromising financial stability.